The Great Depression is characterized by high unemployment rates, increase in poverty, and low profits. While the hardships Americans face today are not similar to the aspects that caused the Great Depression, there are many prominent economic issues that impact today’s society. The present and the Great Depression cannot be fairly compared as circumstances creating economic hardship differ. This, however, does not discredit the fact that financially, people are struggling currently.

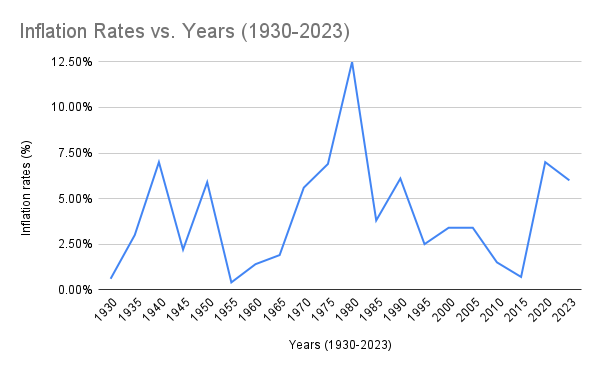

Inflation has caused living during 2019 through 2023 to be stressful. The COVID-19 pandemic was one circumstance that laid the foundation for current economic problems. While the economy is not as daunting as during the Great Depression, some view this economic age as the “Silent Depression.” With the current rise in prices, some people are finding a difficult time adjusting.

“The Silent Depression” is a term used to define the current economic state of the US. Those who use this term refer to the increase in inflation and the effect that it has on the community. While this is not something eye-catching to some, the change in prices can still affect many people and therefore is “silent.”

Inflation has increased since the pandemic and has made living situations stressful. According to the US Department of Agriculture (Economic Research Service), it is predicted that food prices will increase by about 5.6%. Due to pricing for items such as housing and food, the inflation has increased from December of 2022 being 6.5% to “June 2022’s rate of 9.1%, the largest 12-month increase in 40 years,” said State of the Union.

Mr. Szostak, the economics teacher at BHS, said, “the biggest event to impact the economy in the past decade was definitely the pandemic. Certain businesses really suffered because of closings and worker shortages, but others thrived, delivery services, online businesses.”

While the pandemic impacted the unemployment rates for a short time (about 15%), the rates are now at an all time low as the current percentage of unemployment is 3.9% as opposed to the normal rate of 4% to 6%. This is one major difference between the Great Depression and the “Silent Depression” as unemployment numbers were around 25%.

Pricing increases have occurred in many different areas. Food, clothing, and gas prices are just a few examples of industries impacted by inflation. “Inflation spiked for a few reasons, one of them being supply chain issues associated with the pandemic” said Mr. Szostak, “again, due to shutdowns, raw materials and goods weren’t being produced, which made them more scarce and more expensive.”

For instance, gas prices have had an extreme increase from the 1900s. As opposed to oil prices that were about 10 cents a gallon, $1.66 current equivalent (according to Association for Entrepreneurship), the prices now range from about $3.00 to $6.00 per gallon. This is a significant increase from the previous Great Depression gas cost. Even before the war with Ukraine and Russia, the gas prices were still outrageously higher than those in from the Great Depression, a time of economic crisis.

“Oil prices spiked after the Russian invasion of Ukraine, which caused prices of many different goods to increase. The inflation rate is about 3.2% right now, meaning prices are 3.2% higher than a year ago,” said Mr. Szostak.

Affording rent for housing is also a lot more difficult than recent years for young adults. “Inflation definitely has made housing more expensive, which makes it hard for young people to afford a place to live in the housing market,” said Mr. Szostak, “And wages haven’t caught up with the cost of living. People also have a lot more debt than they used to have because they spend more than their income.”

On this topic, Mr. Szostak advises the future generation to “major in something that has a promising job market, live within your means, go to the most affordable college you can, and get a roommate or live at home for a few years after college to build up your savings and avoid debt!”

This economic age has caused some to struggle more financially, or caused distaste for the 2023 prices. Luckily, inflation rates are dropping and “the Federal Reserve [has] a lot of tools to lessen the impact of recessions that we didn’t have during the Great Depression,” said Mr. Szostak, which should keep the “Silent Depression” from reaching the 1929-1941 extremes.

While the hardships faced today are not similar to the ones faced during the Great Depression, there are still daunting aspects of the current economy that severely impact today’s generation. Even though the situations differ, both the Great Depression and today’s economy are similarly detrimental to society’s financial situations.